The other day I asked Michele Caldwell from WCS Lending to put together some answers to the most frequently asked mortgage questions.

Can I get Pre-Approved? Yes, you can. Your information is reviewed and a decision is made as to whether you qualify. As a potential buyer, being pre-approved will give you the best chance of getting the offer accepted. Getting pre-approved means that a mortgage lender has verified that you are approved for a mortgage of a certain amount over a fixed period of time. Pre-approval letters remove the uncertainty in the home-buying process. It is best to obtain a pre-approval letter prior to beginning your real estate search. Real Estate Agents and Sellers see pre-approved buyers as more serious (and more valuable) because they have taken the proactive steps to secure preapproval. Can I get a mortgage after a bankruptcy or with bad credit? Yes, you can still qualify for a home loan however the duration after the bankruptcy has been filed is a factor. Usually, the lower the credit score the higher the rate will be, however a mortgage professional can provide you with a mortgage loan at maybe a higher rate now, along with a plan on how to improve your credit so that within a couple of years you can qualify for the best rates available and the rates you deserve.

How much money do I need in hand to buy a house? Usually, the purchase of a home requires a minimum down payment of 3% to 5% plus funds to cover closing costs. In the case of a FHA Loan, the down payment must be the borrowers own money. Closing costs can be a gift or loan from a relative. What is the difference between interest rate and APR? The interest rate, commonly called the note or base rate, is the rate used to calculate your monthly payments and is the cost to borrow the money disbursed in the loan. The APR is the total cost of the loan over its life, including costs and fees.

What is PMI? Private Mortgage Insurance (PMI) protects lenders against losses that can occur when a borrower defaults on a mortgage. PMI is required on first mortgage purchase transactions when the borrower has less than 20% down payment. Likewise, it is required on first mortgage refinance transactions when the borrower has less than 20% equity in the property being refinanced. The cost of the mortgage insurance is typically added to the monthly mortgage payment. What is the difference between principle and interest? Principle is the amount you actually borrow on your loan. Interest is the fee the lender charges for borrowing. When you make your mortgage payment, a portion goes to paying interest and a portion goes to paying principle.

What is sellers concession? A sellers concession is an agreement in a purchase contract whereby the seller agrees to pay (from the proceeds of the sale) some or even all of the buyers closing costs to purchase the home. This allows the buyer to purchase with less out of pocket expense.

For additional mortgage questions or getting pre-approved for your new home purchase please contact Michele Caldwell at 561-864-5061 or email her directly at michele.caldwell@wcslending.com

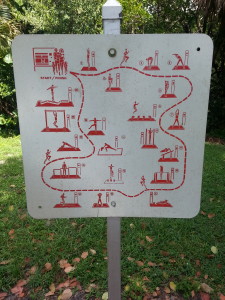

Come out and experience all this property has to offer. This beautiful equestrian property is located in the eastern side of Jupiter Farms on 165th off of Jupiter Farms Road. It is a 5 acre parcel that is fully fenced into 7 paddocks, one is intended to be a dressage rink. A stable building was added in 2010, it includes an office, tack room, living quarters, and 9 standard stables and one rehabilitation stable, and additional storage room. The structure is approximately 130′ by 24′, owners currently have a commercial boarding license for the stables.

Come out and experience all this property has to offer. This beautiful equestrian property is located in the eastern side of Jupiter Farms on 165th off of Jupiter Farms Road. It is a 5 acre parcel that is fully fenced into 7 paddocks, one is intended to be a dressage rink. A stable building was added in 2010, it includes an office, tack room, living quarters, and 9 standard stables and one rehabilitation stable, and additional storage room. The structure is approximately 130′ by 24′, owners currently have a commercial boarding license for the stables.

Follow

Follow